Business Insurance in and around Greensboro

Greensboro! Look no further for small business insurance.

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and a surety or fidelity bond, among others.

Greensboro! Look no further for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

When you've put so much personal interest in a small business like yours, whether it's an alteration shop, a tailoring service, or a book store, having the right protection for you is important. As a business owner, as well, State Farm agent Bobby Simpson understands and is happy to offer exceptional service to fit the needs of you and your business.

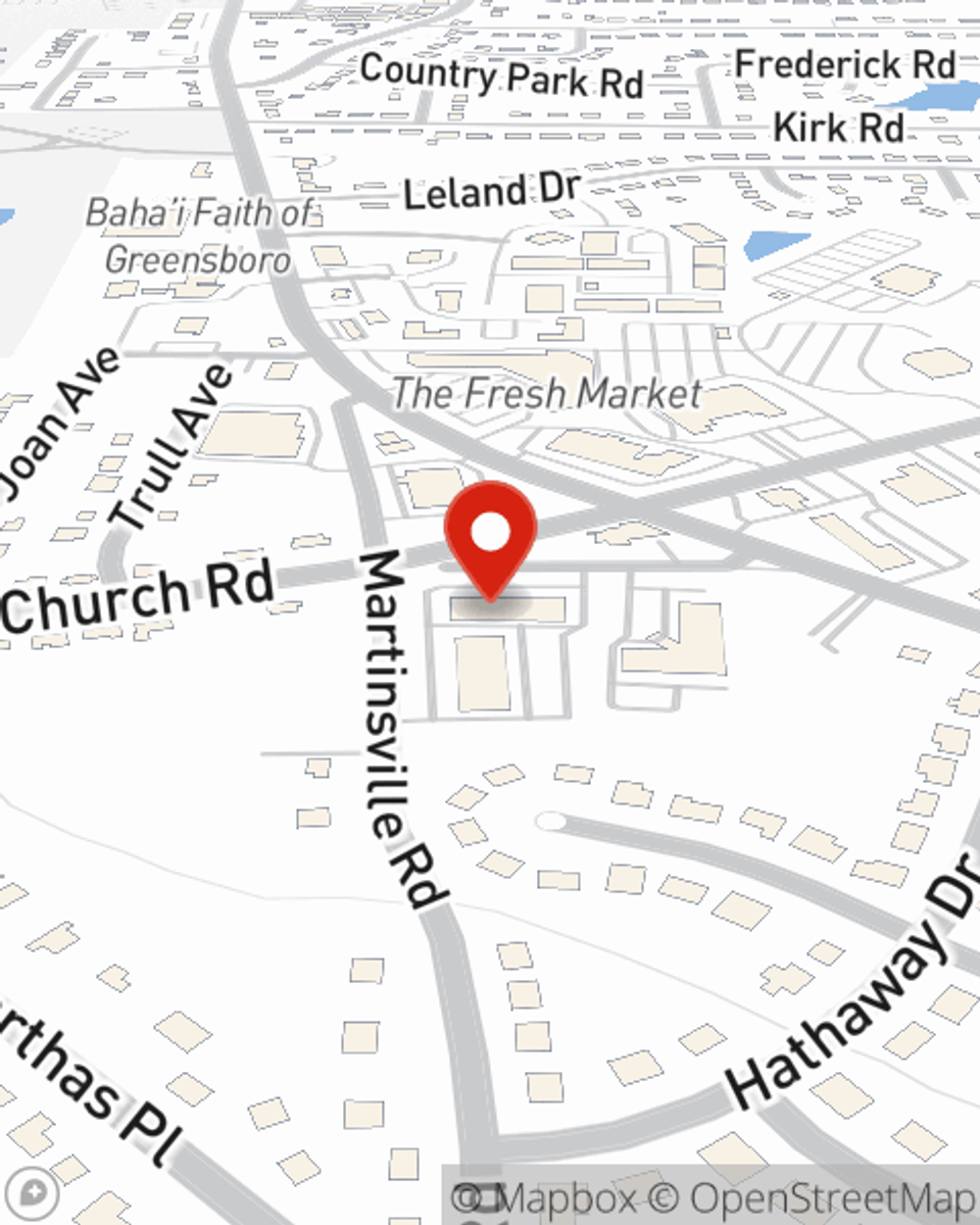

Ready to review the business insurance options that may be right for you? Stop by agent Bobby Simpson's office to get started!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Bobby Simpson

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.